Asset Liability Immunization Strategy (ALIS) Insights 3rd Quarter 2025 Outlook

Executive Summary:

- Strong Q2 risk asset performance, alongside a steepening interest rate curve, led to notable improvements in the funded status of US corporate defined benefit pension plans over the second quarter.

- While inflation signals have softened and the labor market has remained historically strong, the economic outlook is complex due to tariff uncertainties and the resulting Federal Reserve actions.

State of the Markets

The third quarter of 2025 opened with markets in a generally positive mood, carrying over the momentum from the end of Q2. Despite a sharp decline in April due to tariff uncertainty, equities posted very solid gains, with the S&P 500 and NASDAQ both closing Q2 5.5% higher after a remarkable turnaround from the 20% sell-off that occurred in April. Overall, the U.S. stock market experienced a nearly 25% gain in roughly 90 days during Q2. By the time the quarter ended, recession fears had largely abated, although a slowdown is still anticipated in the second half of the year.

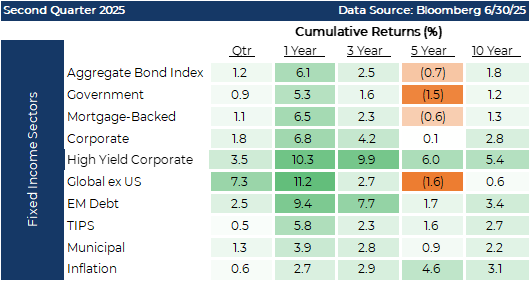

In the bond market, interest rates of short to intermediate bonds fell slightly, while longer-term rates rose marginally. Three-month Treasury bill yields remained unchanged, the 5-year yield decreased by 15 basis points, and the yield on the long bond increased by 20 basis points. Most bond indices delivered positive returns for the quarter. As an example, the 10-year Treasury yield saw a slight increase from 4.2% to 4.23% by the end of Q2.

Key Economic Influences and Events from Q2 2025:

Tariff Volatility: Tariff volatility, which had roiled equity markets in April, decreased in the latter part of Q2. However, the fear and uncertainty surrounding the trade environment initially drained confidence from consumers and small businesses.

Inflation Dynamics: Signs of inflation softened during Q2. The Producer Price Index (PPI) showed elevated cost pressures compared to the Consumer Price Index (CPI), suggesting that producers and retailers might be absorbing more of the trade-related costs. Core CPI for June rose less than analyst estimates for the fifth consecutive month, increasing by only 0.2% month-over-month and 2.9% year-over-year.

Labor Market: Employment environment metrics moved around slightly, but the labor market remained historically strong throughout Q2. For June, the unemployment rate fell to 4.1% after three months at 4.2%. There were 1.1 jobs per job seeker. We interpret these metrics as the definition of full employment.

GDP Expectations: Q1 GDP registered a slight decline, coming in at an annual rate of -0.5%. The expectation for Q2 GDP, as of the time of writing, was close to 2.6%. The Atlanta Fed GDPNow model is forecasting a seasonally adjusted Q3 GDP of 2.5%.

U.S. Credit Rating Downgrade: On May 16, Moody’s Investors Service downgraded the U.S. sovereign credit rating, citing concerns about rising national debt, persistent deficit spending, and an elevated debt-to-GDP ratio. This event contributed to the initial shoot-up in Treasury bond yields earlier in the quarter.

Pension Market Update

As we move into the third quarter of 2025, the pension market has shown resilience and notable improvements in funded status during Q2 2025, following a period of significant volatility. The second quarter of 2025 brought positive news for US corporate defined benefit pension plans. Funded status generally improved across various indices, primarily driven by strong risk asset performance in relation to the offsetting effects of interest rate movements which cause liability values to change.

Multiple Key Market Movements Influenced the Pension Market:

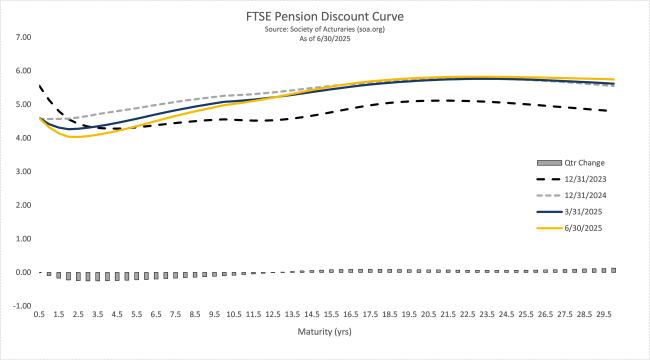

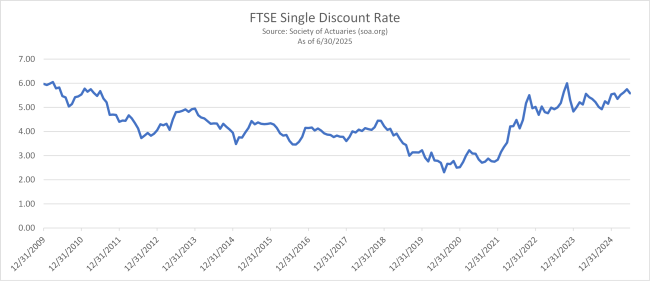

Treasury Yields and Discount Rates: The yield curve steepened over the quarter. Shorter-term yields declined due to a softer economic outlook, while longer yields rose on concerns about US debt sustainability. For instance, 2-year yields ended Q2 16 basis points (bp) lower at 3.72%, while 30-year yields rose 22bp to 4.77%. Discount rates used for pension liabilities showed varied movements depending on the provider and their unique methodology ranging from -18 bp to + 4 bp. Overall, the FTSE discount single rate increased 6bp over the quarter and 75bp on a year-to-date basis.

Corporate Credit Spreads: Corporate credit spreads generally tightened over the quarter. Aggregate US corporate spreads ended Q2 11bp tighter. The long maturity component of the credit curve outperformed, with spreads tightening by 16bp, compared to an 8bp tightening in the intermediate area. BBB credit also outperformed other rating categories in long maturities. However, the number of fallen angels – issuers downgraded from investment grade to below investment grade – accelerated significantly. As of May, $21 billion in downgrades occurred, nearly three times the record low in 2024, with Warner media’s $15.2 billion debt transitioning further into high yield in June being a notable example. Approximately $112 billion of debt remains at risk of downgrade, particularly from issuers hovering at the BBB- threshold like Ford and Boeing. While this is a headwind for passive investment-grade investors, the trend presents a compelling opportunity for institutional investors to evaluate individual credit risks.

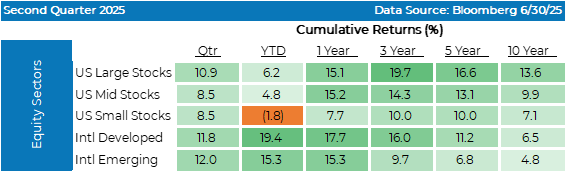

Domestic Equity Markets: Equity markets experienced a volatile but ultimately strong quarter. The S&P 500 Index saw a sharp sell-off following new trade tariffs but rebounded strongly to a new all-time high by quarter-end, resulting in an 10.9% return for Q2 and pushing year-to-date returns into positive territory. Global equities also delivered positive performance. The MSCI Emerging Markets Equity Index returned 12.0% in Q2 and 15.3% year-to-date.

Economics: The global economic outlook remains cautious through 2026, with downward revisions to growth forecasts, particularly for the US economy, which is expected to decelerate sharply to 1.5% in 2025 from 2.8% in 2024. While CPI is projected to ease globally, US CPI is expected to remain above the Fed's 2% target in both 2025 and 2026. The Federal Reserve is anticipated to be constrained by tariff-related inflation, opting for a cautious rate cut toward year-end before initiating a more substantial easing cycle. Radical fiscal and trade shifts by the new US administration are increasing forecasting uncertainty.

Pension Risk Transfer (PRT) Market: 2025 PRT activity measures approximately $5.5 billion and amounted to a total of $23.4 billion for FY2024. It is generally anticipated that PRT activity will continue at levels similar to 2024, as plan sponsors with growing surpluses may explore options like reopening frozen defined benefit plans.

Economic Outlook

Looking ahead, several critical issues persist that will undoubtedly shape the economic landscape. Tariff uncertainty continues to create a difficult operating environment for businesses, potentially leading to less economic activity and lower GDP as major investments are delayed due to unknown costs. While the rhetoric surrounding tariffs has mostly been overcome, the potential for volatility to reignite remains. The rationale behind the tariffs has increasingly shifted towards generating revenue and improving job prospects. Moreover, the potential for higher tariffs raises the likelihood of higher inflation, which could, in turn, remove the possibility of interest rate cuts. While Core CPI has moderated, the Producer Price Index (PPI) remains elevated compared to CPI, suggesting that producers and retailers may currently be absorbing more of the changing trade costs rather than consumers. Beyond economic factors, the global geopolitical situation remains tense, particularly with Iran, and any attack on the U.S. could have severe short-term market consequences.

Domestically, the regulatory and fiscal health of the nation is a significant concern. The Trump Administration’s Big Beautiful Bill (BBB), passed post-Q2, provides some much-needed clarity by averting a debt ceiling crisis and advancing tax and spending plans. However, the Congressional Budget Office (CBO) scores the BBB as adding a substantial $2.4 trillion to the deficit over the next decade. While the administration contends this assessment is flawed, arguing that tariff revenues are not considered and that stronger GDP growth could make the bill more deficit-neutral, the U.S. is undoubtedly facing significant fiscal challenges. This was underscored by Moody's Investors Service's downgrade of the U.S. sovereign credit rating in May, citing concerns about rising national debt and persistent deficit spending. The nation currently pays over $1.2 trillion annually in interest on its debt, a figure that is exacerbated by unnecessarily high short-term interest rates.

Regarding Federal Reserve (Fed) policy, the market widely expects two 25-basis point rate cuts before the end of the year. However, Fed Chair Powell has indicated that tariff uncertainty is a reason to maintain a restrictive policy stance. Despite a robust labor market, with unemployment falling to 4.1% in June, and moderating inflation, the Fed appears to be operating with a management by feel approach rather than being purely data dependent. Our expectation is for a potential market surprise with no rate cut in September, followed by a well-telegraphed 50-basis point cut in December. The timing of cuts will likely hinge on decreasing tariff uncertainty and the degree of demand pull-forward generated by final trade agreements. Importantly, Fed action is anticipated to be in defense of the employment market's continued health rather than solely driven by inflation. As previously mentioned, unnecessarily high short-term rates exacerbate the deficit, increasing the cost of financing the substantial amount of U.S. Treasury debt to be rolled over.

While the second quarter ended on a surprisingly strong note for equity markets, the economic outlook remains complex, influenced by persistent tariff uncertainties, geopolitical risks, and significant fiscal challenges. The Federal Reserve's cautious, management by feel approach, especially concerning tariffs, suggests that market expectations for immediate rate cuts may need to be adjusted, with our outlook pointing towards a later, more substantial cut. We will continue to monitor these developments closely to provide you with timely insights.

Investment Strategy

In this environment, a more conservative approach would be to extend the portfolio maturity in anticipation of a slowdown or mild recession. Lower rates would cause longer bond prices to rise, potentially seeing a greater market value change than shorter-maturity bonds. The U.S. 10-year Treasury yield is currently near 4.25%. We foresee a bull steepener scenario, where short rates fall more significantly than the intermediate segment of the yield curve, while longer rates remain anchored by high real rates until there is greater clarity on federal deficits and new debt supply. Our portfolio construction views continue to rely on short-term bonds as a stabilizing component, offering historically attractive real yields. We also favor high-quality issues spread throughout the 5-year to 10-year part of the curve. While we don't anticipate significant price appreciation at the long end of the curve, current high real rates typically indicate a good time to incorporate longer dated maturities. The range of potential economic outcomes is notably wide. We are operating in times of seismic change, requiring careful and adaptable investment strategies.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education, relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.