Asset Liability Immunization Strategy (ALIS) Insights 2nd Quarter 2025 Outlook

Executive Summary:

The first quarter of 2025 was marked by significant policy uncertainty, especially related to tariffs, which contributed to market volatility and a decrease in pension funded status for typical corporate defined benefit plans as liability performance outpaced asset performance.

The 2025 Milliman Corporate Pension Funding Study revealed that, as of the end of FY2024, the aggregate funded status for the 100 largest US corporate plans reached a surplus (101.1%) for the first time since FY2007, primarily driven by a rise in discount rates that decreased liabilities.

Despite market volatility, the U.S. Treasury market continued to be viewed as a "flight to quality" asset. We recommend an investment strategy in this environment where a focus on high-quality individual fixed income securities using a barbell approach as the most appropriate strategy.

State of the Markets

The first quarter of 2025 brought mixed results in the capital markets, influenced by the Trump administration's implementation of campaign promises which was in contrast with the final quarter of 2024, when the reality of the second Trump administration was achieved and capital markets reacted with a positive response. Recent actions, now that the administration is in place, have led to significant valuation changes in both domestic and international assets as the capital markets digested the new developments. For instance, volatility in domestic equities spiked just after the quarter ended, and derivatives based on the domestic bond market showed a similar reaction. The degree of volatility confirmed that some of the proposed changes would have near-term disruptive effects as markets discounted the ambiguity of future growth. Key areas of concern included uncertainty surrounding tariffs, government efficiency, regulatory changes and global conflicts, with the potential for recessionary effects being the most significant near-term negative consequence.

Changing how we trade goods and services with our international partners will cause near-term disruptions. However, given enough time, these changes may positively impact the economy. The question is whether market participants, producers, consumers, politicians, and trading partners can endure the process until the economy reaches the finish line, which may take many years or even a decade to achieve. In the meantime, we fully expect continued bouts of volatility in asset values as this dynamic plays out.

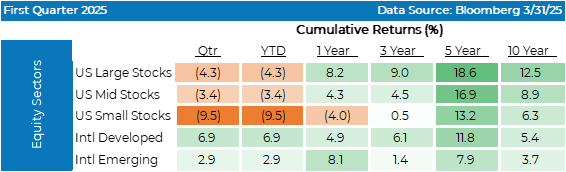

Domestic equities began the quarter by extending their late-2024 rally, however, that momentum quickly collapsed, resulting in a decline of US Large stocks of over 4%, formally entering a correction after peaking in early February. The tech-heavy "Magnificent 7" stocks, which had driven much of the previous year’s gains, bore the brunt of the first quarter’s sell-off. Their sharp decline accounted for nearly the entire drop in the S&P 500. Sector rotation was another defining theme. Growth stocks faltered, while value-oriented sectors such as energy, healthcare, and basic materials outperformed. This reversal highlighted the importance of portfolio diversification.

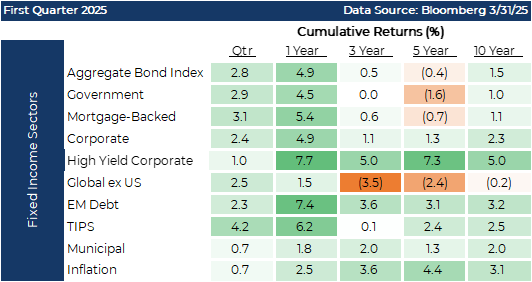

While equities stumbled, the bond market offered a safe harbor as interest rates declined. The Aggregate Bond Index rose 2.8% during the quarter, buoyed by falling rates over nearly the entire yield curve and a shift in investor sentiment toward risk aversion. Concerns over slowing economic growth and geopolitical instability drove investors to favor U.S. Treasuries. The Federal Reserve, while not yet cutting rates, signaled a more cautious stance, which helped support bond prices. However, not all fixed income segments fared equally with municipal bonds underperforming relative to Treasuries, as did high-yield corporate bonds.

Pension Market Update

The pension market during the first quarter of 2025 was characterized by significant uncertainty which led to a decrease in pension funded status for typical US corporate defined benefit plans. Plans with a liability focused strategy saw their funded status decline on average 1.7% in Q1 2025, as measured by a consortium of pension tracking indices. This decline followed a period of significant improvement in funded status during 2024 where the average plan increased its level of funding by 5.3%. The quarterly decrease in funded status was primarily driven by market movements where liability performance outpaced asset performance.

Several key market movements influenced this outcome:

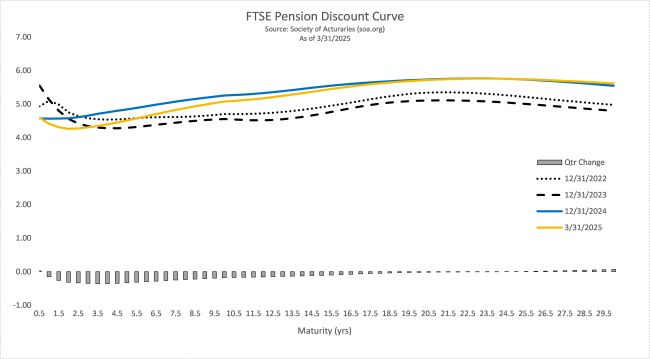

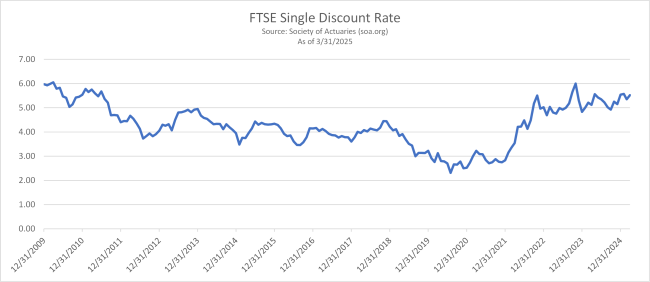

Treasury yields and discount rates declined over the quarter. This was attributed to concerns about the near-term growth outlook amid tariff uncertainty and government layoffs, as well as a slowdown in the Fed's balance sheet reduction pace. For example, two-year yields ended the quarter 32bps lower, and 30-year yields finished 14bps lower. For underfunded plans, the net effect from decreased yields resulted in higher liability values.

Corporate credit spreads widened. Aggregate US corporate spreads ended Q1 14bps wider. This widening effect mitigated the benefit of falling Treasury yields, resulting in the Bloomberg Corporate Index underperforming its Treasury equivalent. Spreads widened more significantly at the long end of the credit curve (18bps) compared to the intermediate area (12bps). An increase in bonds downgraded from investment grade to high yield ("fallen angels") at the start of 2025 was a key theme that created opportunities for actively traded fixed income managers.

Domestic equity markets declined. The S&P 500 Index fell by 4.3% over the quarter, following a strong performance in 2024. Global equities experienced positive performance, somewhat driven by a weaker dollar, with the MSCI EAFE index up 7.3% in the first two months of the quarter alone.

Economically, Q1 2025 saw growth forecasts for the US and Europe decline, while inflation forecasts were increased. These shifts were largely linked to President Trump’s trade policies. The Federal Open Market Committee also reduced its growth forecasts and raised inflation forecasts in its March meeting.

In the Pension Risk Transfer (PRT) market, Q1 2025 saw approximately $5.5 billion in total transactions, which is considered a relatively normal level. The decline in interest rates used for annuity pricing made PRTs more expensive, but a subsequent pause in tariffs led to a significant rebound in rates. Annuity purchase interest rates saw a modest increase in March. Plan sponsors initially paused PRT activity to observe market developments, but the interest rate turnaround encouraged some to look to transact quickly. The market downturn presented challenges for underfunded plans, potentially leading to increased required contributions.

The 2025 Milliman Corporate Pension Funding Study was recently published. This study provides insights into the status of the 100 U.S. public companies with the largest defined benefit pension plan assets across various business sectors and analyzes the pension plan accounting information disclosed as of the end of their fiscal year FY2024.

A key finding for FY2024 was the improvement in the aggregate funded status of the index. The funded percentage increased from 98.5% at the end of FY2023 to 101.1% at the end of FY2024. This marked the first time since FY2007 that the aggregate funded ratio ended the fiscal year in a surplus position. The funded status improved from a $19.9 billion deficit to a $13.8 billion surplus.

This improvement in funded status was primarily driven by a larger decrease in liabilities compared to their related assets. The decrease in liabilities was fueled, in part, by a 42-basis point increase in the average discount rate, rising from 5.01% in FY2023 to 5.43% in FY2024. This rise in discount rates reduced the Projected Benefit Obligations (PBOs), which decreased from $1.336 trillion to $1.243 trillion.

The average investment return for the Milliman 100 plans in FY2024 was 3.6%, which was below the average long-term assumed rate of return of 6.5%. This resulted in an estimated net $44.8 billion investment loss for FY2024. Only 19 out of the 100 companies exceeded their expected returns in 2024. Plans with higher equity allocations tended to have higher returns in 2024.

Regarding asset allocation, the study noted a slight reversal in the trend towards liability-driven investing (LDI) in 2024. Fixed income allocations decreased slightly to an average of 52.4% from 53.8% in FY2023, while equity allocations increased slightly to 24.6% from 23.7%. This decrease in fixed income allocation is the first seen in the study since 2013 and might be due to allocation drift from fixed income underperforming equities in 2024. Plans with higher fixed income allocations generally underperformed other plans in FY2024 in terms of investment return but experienced lower funded ratio volatility over the last five years.

Pension risk transfer (PRT) activities, such as annuity purchases and lump-sum windows, continued to be used by plan sponsors as risk management tools. The estimated dollar volume of PRT activities for the Milliman 100 companies in FY2024 was $23.4 billion, an increase from $19.8 billion in FY2023.

Employer contributions increased slightly to $17.6 billion in FY2024 from $16.3 billion in FY2023, although these levels remain significantly lower than in prior years like 2017 and 2018. Net Periodic Pension Cost switched from an expense in FY2023 to an income of $2.4 billion in FY2024.

Looking ahead, expectations for 2025 included potentially higher plan sponsor contributions due to lackluster early 2025 asset performance, continued pension income, and the potential for interest rate movements to impact funded status and asset-liability matching strategies. The growing number of plans with surpluses might lead to more interest in reopening frozen DB plans, and PRT activity is expected to continue at similar levels to 2024, though recent lawsuits could potentially slow it.

Economic Outlook

The central feature of the current economic debate is the administration's tariff policy. The goals appear to be multifaceted: generating revenue, bolstering American jobs, and achieving more favorable trade agreements. There is a long-term strategic goal to onshore value-added industries such as semiconductors, pharmaceuticals, and medical devices, which could provide a source of utility for the American consumer. However, we concur with economic studies that the 2018-2019 tariffs were a net negative for the economy. Tariffs are, in effect, a tax on consumption, with the burden shared among exporting companies, retailers, and consumers. Research indicates that every 10 percent increase in tariffs translates to about a one percent rise in producer prices and a 0.3% increase in the consumer price index (CPI). One working paper by the Richmond Fed found that tariffs led to $51 billion in losses for consumers and firms, with a net economic loss of $7.2 billion or 0.04% of GDP even after accounting for job gains in protected industries. As a consumption tax, tariffs are likely to be regressive, placing a larger financial strain on lower-income households as a percentage of their disposable income.

We can also look at international precedents for guidance. Japan has enacted three major consumption tax hikes, and in each instance, consumption rose just before the hike and then fell significantly afterward. This effect could be more pronounced in the United States, where consumption accounts for 69% of GDP, compared to 53% in Japan. In Japan, household spending has still not returned to the levels seen before the 2014 tax hike. Following a previous hike in 1997, the shortest recovery period for consumption to return to its prior level was 45 months - a duration of short-term pain that is likely politically untenable in the U.S. We anticipate a similar dynamic: a near-term acceleration of consumption, followed by a lull after tariffs are implemented.

Despite the economic headwinds, the current policy feels like a forgivable episode. The pursuit of fairer trade policies is a defensible position, and if they prove too damaging, we believe the administration can reverse course.

"Recent data has shown a welcome moderation in inflation."

Against this backdrop, the Federal Reserve finds itself in what the market has termed a "Sophie's Choice" between fighting inflation and supporting employment, though we believe the choice is less agonizing than it appears. Recent data has shown a welcome moderation in inflation. The April month-over-month CPI reading saw its largest decline since June 2020, falling 0.1% against expectations of a 0.1% increase. On a year-over-year basis, headline CPI stands at 2.3% with core CPI at 2.8%. With the 25-year average for CPI at 2.5%, inflation is effectively average or slightly below average.

Simultaneously, the labor market remains robust by historical standards, with an unemployment rate of 4.2% constituting what is essentially full employment. Given that inflation is near its historical average and the labor market is tight, we believe the Fed is prudent to maintain its slightly restrictive policy stance. The most likely path is that the Fed will remain on hold until employment measures begin to deteriorate per their own guidance. While consumer sentiment is low and long-term inflation expectations are elevated, we do not anticipate the Fed will alter its policy based on uncertainty alone. A genuine liquidity shock or a clear weakening in the labor market would be the necessary catalysts for a change in course.

The uncertainty surrounding trade policy has created volatility in the U.S. Treasury market. The 10-year Treasury yield currently sits near 4.5%, and the “higher for longer” narrative seems poised to hold for much of this year. It was a sharp move in Treasury yields that likely prompted the administration to pause the broad implementation of tariffs. While there is chatter about foreign partners selling Treasuries or the dollar's status as the world's reserve currency being challenged, we view this as largely posturing within a tough negotiating environment. At present, there is no viable alternative to U.S. Treasuries as the backbone of the global financial system. We expect that during any future global financial stress; the U.S. Treasury market will benefit from a “flight to quality.”

Our primary strategic recommendation in this environment is to maintain a focus on quality. Yields are at historically attractive levels, and we believe it is wise to capture this benefit without taking on undue risk. We suggest employing a barbell strategy to balance performance and risk. Short-Duration Stability: We advocate holding cash equivalents and short-term bonds, which currently offer historically attractive yields and provide a stabilizing anchor to many portfolio mandates. Longer-Duration Opportunity: On the other side of the barbell, we like high-quality bonds in the 5- to 10-year portion of the yield curve. This segment of the strategy stands to benefit from two potential scenarios. First, a “flight to quality” event or a calming of rhetoric about the safety of U.S. assets would likely cause Treasury yields to fall, leading to price appreciation. Second, if the American consumer becomes exhausted and the economy slows, this longer-duration segment of the portfolio should also see price appreciation.

While the policy landscape is complex, the economic fundamentals of near-average inflation and full employment provide a decent foundation. The primary risks are policy-driven and are likely reversible. Our strategy is designed to weather the current uncertainty while capitalizing on the attractive yields available in high-quality fixed income.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education, relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.