Asset Liability Immunization Strategy (ALIS) Insights 2nd Quarter 2023 Outlook

Executive Summary:

o Q1 2023 saw a robust economy with lowering unemployment and persistent but slowly declining inflation, leading to doubts about the need for future Fed rate increases.

o Unexpected bank failures highlighted the consequences of tight central bank policies and capital access challenges, impacting the economy and potentially reversing the strong job market.

o The market now expects future cuts in the Fed Funds Rate, the breaking point may come if inflation reduction actions overly impact consumers.

State of the Markets

During most of the initial quarter, the economy appeared to be largely resistant to the Federal Reserve's series of tightening measures. Highly financed items, like houses and automobiles, saw a decline in value, while the job market remained robust and inflation indicators generally defied the Fed's objectives. The situation escalated to the point where doubts arose about the need for the Fed to implement future rate increases to curb potential runaway inflation. The Consumer Price Index (CPI) revealed a persistent, although falling annual inflation rate, as January measured 6.4%, February measured 6.0% and March came in at 5.0%, all significantly above the Fed's target of 2%. The first quarter's economic strength was emphasized by the January employment report, which showed the unemployment rate falling to 3.4%, its lowest level in over half a century. Exuberant market analysts predicted a "Goldilocks" scenario, where employment remained strong and economic challenges were minimal, yet inflation would be kept in check. The robust economy in January, reported mainly in February, led to rising yields and concerns about corporate profits and a housing market slowdown due to higher mortgage rates. However, it was the less obvious, yet vital, aspects of the economy that caused risk appetites to moderate.

"These domestic bank failures could significantly impact the economy, potentially reversing the course of the strong job market."

In Q1 2023, unexpected bank failures, including the acquisition of Credit Suisse by UBS and the collapse of Silicon Valley Bank and Signature Bank, highlighted the consequences of tight central bank policies, capital access challenges, and unforeseen liquidity needs. These domestic bank failures could significantly impact the economy, potentially reversing the course of the strong job market. Online banking introduced a "speed of money" risk, requiring potentially new and innovative solutions to ensure safe and sound financial institutions.

Since Q3 2022, we have suggested that the Fed would maintain its restrictive stance until something gave way. The recent banking turbulence led to a mix of technical and obfuscated responses, including temporary guarantees of deposits and the introduction of the Bank Term Funding Program (BTFP). Our mission-focused Fed aims to reduce inflation to their long-term target of 2%. The market expects a 50-basis point cut in the Fed Funds Rate this year, with the Fed's flexible actions indicating that targeted responses will be prioritized over blunt instruments. The breaking point may come if the burden of inflation reduction ultimately impacts the consumer which dictates 70% of our domestic service-driven economy.

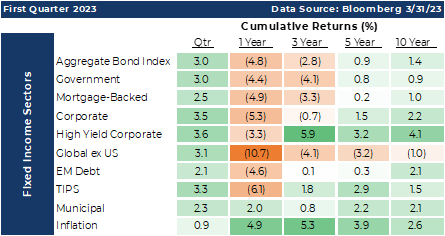

10-Year Treasury yields got as high as 4.07% in the first quarter and ended up at 3.47%. Through the end of the first quarter, the most broadly watched bond indexes experienced returns of 2.1% to 3.6%. Bond sectors with greater credit risk relative to treasury bonds produced higher returns. On a year-over-year basis, all but two sectors, Municipal and Inflation, produced negative rates of return.

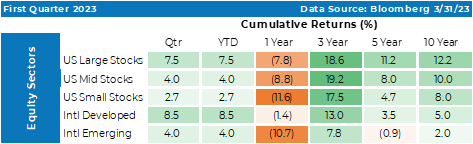

Equity sectors produced a similar response to the changing economic environment with positive returns being evident across all the various sectors while year-over-year returns provided negative results. Three-year returns are now well above long-term averages. Domestic equity valuations hover around long-term averages at the end of the quarter with growth stocks reversing their trend of underperforming value as we saw in calendar year 2022.

Pension Market Update

2022 provided a year of excellent performance in defined benefit pensions funding status, as the dramatic rise in interest rates resulted in a diminished value in pension liabilities and more than offset the negative impact of the equity market. Many plans experienced double-digit gains in funding. To begin 2023, this trend has reversed modestly. The net effect is that many traditional defined benefit plans have seen a slight decrease in their funding with rates slightly lower to end the quarter causing liabilities to increase in value and overshadow the positive quarterly return in risk assets.

Cash balance plans, which determine their funding directly from asset returns relative to their crediting rate, experienced positive returns in the quarter as both risk assets and fixed income assets bounced back from their dismal performance in 2022. As a result, many cash balance plans are beginning to dig their way out of the deficit they experienced previously.

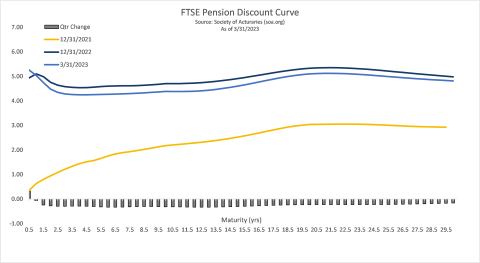

Movements of interest rates and capital market risk sectors explain much of the migration of surplus or deficit in pensions plans whether they are a traditional defined benefit plan or cash balance plan. As evidence of interest rate movements, it’s beneficial to examine the movement of rates at maturity points along the yield curve. Traditionally, defined benefit plans discount future liability cash flows using a pension discount curve such as the FTSE Pension Discount Curve. On closer inspection the movements over the past calendar year are significant with the average maturity experiencing a rise of over 1.50%. The effect of discounting future cashflows by a larger rate is a decrease in value which is why we have seen many plans improve their funding by more than 10%. Nonetheless, the opportunity to de-risk a pension plan is clearly evident. De-risking can be thought of as a multi-step process where the asset portfolio is constructed in a manner to reduce the price volatility and coordinate the effects of rate changes between the liabilities and assets. Often the next phase includes a transaction which is referred to as pension risk transfer (PRT) where a particular cohort of the plan’s participants are offered a lump sum buyout, often times at cost that is less prohibitive for the sponsor. The market for PRT continues to evolve in size and sophistication. Finally, termination of a plan is commonly thought of as the final step to de-risking. Both PRT and termination will continue to be important topics for plan sponsors in 2023 although we would emphasize the need to restructure a portfolio and address the interest rate risk that can reduced through the use of a strategy such as ACG’s Asset Liability Immunization Strategy (ALIS).

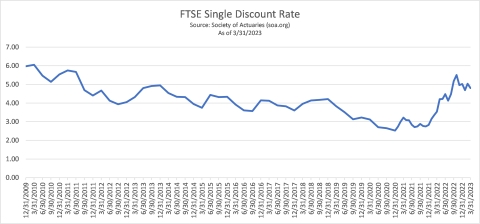

A summation of movement along the yield curve can be evidenced by examining the FTSE Single Discount Rate in the attached graph. At any one single point in time the level is measured as the average rate across the entire curve. In this representation, the long-term trend in discount rates is clearly evident. Over the recent past, rates have trended higher and therefore pushed liability values lower providing the aforementioned opportunity to begin de-risking.

Economic Outlook

In previous editions of Insights, we discussed the challenges faced by the U.S. dollar in maintaining its status as the global reserve currency. We also talked about the need for larger amounts of stimulus in subsequent emergencies, the changing landscape of global trade, and the impact of technology on inflation and human capital. These dynamics continue to shape the global economy and have significant implications for the U.S.

Factors such as protectionism, tax policy, collectivist versus individualist interpretations of social contracts, and military conflict could lead to unforeseen consequences. It remains uncertain whether institutions will reduce risk exposure before consumer strength falters or if the latter will trigger risk aversion. We predict that increased borrowing costs, manufacturing inefficiencies due to shifts in global supply chains, and a profitability recession will cause institutions to reduce their risk appetites.

"We predict a gradual decline in the economy's psyche as consumers face growing stress."

While U.S. consumers have been slow to change their spending habits, they may not be the key to reducing inflation expectations. Consumer credit card balances have surpassed pre-pandemic highs, and although delinquencies are historically low, they seem to be rising in 2023. Subprime auto borrowers are also struggling with an increasing percentage of late payments. In early April, respondents to a New York Fed survey expect prices to rise by a half a percentage point to an annual gain of 4.75%. They expect gas prices to rise by 4.6% and food prices will be 5.9% higher. Clearly, consumers do not anticipate a near-term Fed victory against inflation. We could also envision a scenario where their access to credit diminishes, as it did between 2008 and 2009. Although unemployment has dropped to 3.5%, job vacancies at U.S. employers have also fallen. We predict a gradual decline in the economy's psyche as consumers face growing stress.

There are several wildcard developments that may have unknown effects, including the debt ceiling, polarized political parties, and threats to the U.S. dollar's status as the world's primary reserve currency. The erosion of the Petrodollar, weaponization of the SWIFT international payments system, and decreased U.S. energy production also contribute to these concerns.

"Declining corporate profits and increased borrowing costs have the potential to significantly alter the economy's trajectory."

Declining corporate profits and increased borrowing costs have the potential to significantly alter the economy's trajectory. With banks paying more for deposits and lending less, profits are likely to suffer. Over the next couple of years, billions of dollars in office-related commercial real estate and high-yield corporate debt will need to be refinanced. Rising borrowing costs and a potential recession could exacerbate the challenges faced by these companies. The market may be underestimating the risks associated with office-focused commercial real estate, as remote work has led to increasing vacancy rates. This could have a chilling effect on credit access and risk appetite in financial markets.

Although the Fed has been agile in the past, a more gradual approach may be necessary now. ACG expects the Fed to raise the Fed Funds Rate by 25 basis points in May and then pause for an extended period. However, if credit conditions worsen, the probability of a Fed rate cut by year-end could increase. The combination of continued Quantitative Tightening and at least one more rate hike, amid a profitability recession, could make for challenging times for risky assets, while high-quality bonds may appreciate over the next year.

In conclusion, our hope is for a soft-ish landing but we’re preparing for a potentially rougher economic climate as the dynamics at play continue to unfold.

**For the periods shown, performance figures are sector-wide. It is not possible to invest directly in a sector and the performance shown should not be construed to be the performance of any actual account.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.